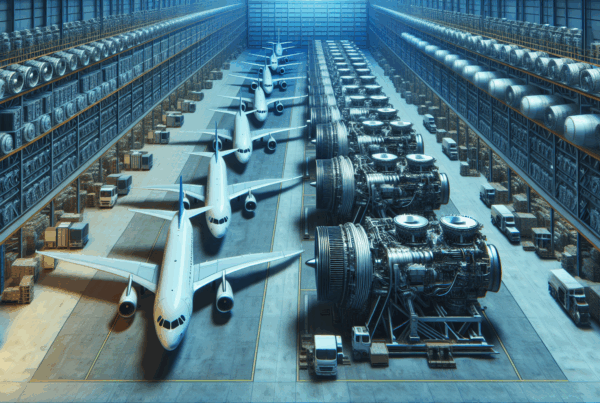

The leisure company Edelweiss Air continues its renewal with the acquisition of five Airbus A320neo used vehicles from the Lufthansa. These aircraft, currently operated by Austrian AirlinesThese will reinforce a short- and medium-haul fleet that will grow to 18 aircraft by 2028. Operational from 2027-2028, this transition illustrates a pragmatic strategy combining cost optimization and modernization, while fitting into the Group's ecosystem including Swiss International Air Lines, Eurowings and Brussels Airlines.

Edelweiss Air: five second-hand A320neo aircraft from the Lufthansa Group to modernize the fleet

The arrival of these five Airbus A320neo will gradually replace older aircraft and increase capacity on European and Mediterranean routes. The operation is based on internal transfers within the group, a common channel among Star Alliancewhich facilitates device mobility between entities such as Swiss International Air Lines and Austrian Airlines.

Why choose pre-owned A320neo aircraft? Efficiency gains and a realistic timetable

Buying second-hand equipment speeds up commissioning, without having to wait for the often-delayed delivery of new equipment. Visit A320neo offer a significant reduction in fuel consumption per seat compared with previous generations, a decisive argument for a company focused on vacation flights.

By selecting machines already configured for short rotations, Edelweiss Air reduces conversion costs and shortens fleet integration times. This pragmatic choice illustrates the balance between environmental performance and operational constraints. Insight: second-hand vehicles are sometimes the quickest way to modernize.

Operational and network consequences: capacities, rotations and maintenance

The arrival of these aircraft is changing the planning of seasonal rotations and programmed maintenance. A fictitious fleet manager, Captain Muller, follows the transition: he anticipates gains in availability and fuel costs, while coordinating crew training on the specific systems of the A320neo.

At the same time, integration into the Group's network implies synergies with Eurowings or Brussels Airlines to optimize traffic rights and slots. Aircraft transfers between group companies Lufthansa are documented in other fleet movements, such as the recent arrival of an A320neo by Lufthansa City Airlines (read the case).

Modernization also makes it possible to compete more directly with aircraft of the Boeing on certain rotations, while taking advantage of the fuel economy of the A320neo. Insight: availability and operational flexibility become immediate competitive advantages.

Markets, financing and the 2025 context: opportunities and precedents

The use of second-hand aircraft is part of a market in which orders and deliveries are subject to tight cycles. Some operators, such as Avolon and Cebu Pacific, have placed massive orders for new A320neo and A321neo aircraft (Avolon, Cebu Pacific).

The second-hand approach avoids production delays, as illustrated by the initial commissioning of a A320neo at Edelweiss (back to the previous finish), and offers a faster path to operational savings.

The industrial and safety context also feeds into decisions: engine incidents, stopover management or passenger preferences all have an impact. Stories of engine incidents, though rare, remind us of the importance of rigorous maintenance (example).

The evolution of theEdelweiss Air can also be seen through a competitive prism: some rivals are improving comfort on Boeing or deploy new layouts on Airbus (reference A321neo), while others are redefining long-haul capacity. Insight: the diversity of approaches shows that used and new aircraft are complementary responses to the constraints of 2025.