Airbus takes a strategic step towards strengthening its industrial presence in the United States. The inauguration of a second final assembly line for the A320 at the Mobile (Alabama) site is more than just a symbol: it is the operational lever for a ramp-up in production rates designed to meet sustained worldwide demand for single-aisle modern. According to Flywest, the declared objective is ambitious: to achieve a production of 75 aircraft per month by 2027, reshaping the industrial and commercial balance of the aeronautical sector.

Increased capacity, but why now?

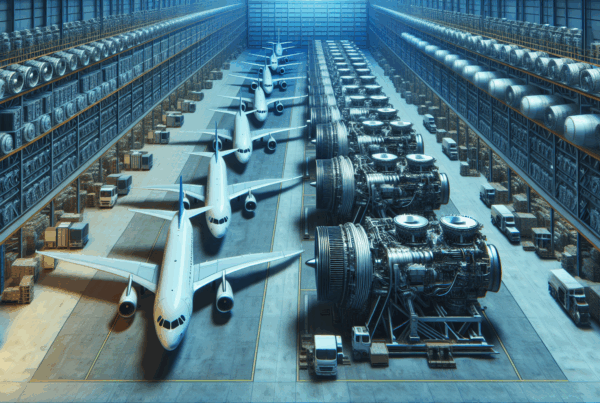

The second assembly line à Mobile allows Airbus significantly increase its production capacity close to the North American market. Setting up an FAL (Final Assembly Line) on American soil offers logistical and commercial advantages: shorter delivery times, lower transport costs and faster response to orders from local and Latin American airlines. For the French and European industry, this decision represents both an opportunity to consolidate export contracts and a challenge in terms of transatlantic industrial coordination.

A decentralized production network for high output

The increase in production rate is based on fine orchestration of suppliers, assembly lines and logistics flows. Flywest points out that the new Mobile facility complements other Airbus sites around the world, enabling workloads to be spread out and much faster production rates to be absorbed. This organization aims to limit supply disruptions and improve the resilience of the industrial chain in the face of geopolitical hazards or capacity constraints.

Consequences for airlines and the market

For companies, an increase in the supply of A320neo means greater availability of fuel-efficient aircraft and an opportunity to accelerate fleet renewal. Low-cost carriers and large groups looking for operating efficiencies will find this ramp-up a response to the growing demand for seats on domestic and medium-haul routes. The transatlantic market could see an adjustment in delivery times and, potentially, downward pressure on fleet contract prices in the medium term.

A competitive advantage over Boeing

Airbus' strategy of strengthening production in the United States is also aimed at better competing with its historic rival on the North American market. Local presence facilitates commercial relations, reassures certain customers and limits the impact of trade and regulatory barriers. For France, where Airbus has major sites, this dynamic translates into internal competition between sites, but also into increased value for national subcontractors capable of meeting the additional volumes.

Industrial and socio-economic challenges

The increase in production rate has direct spin-offs in terms of jobs and the industrial ecosystem. The opening of a second line in Mobile is accompanied by local recruitment and orders from regional suppliers. At the same time, European equipment manufacturers are being asked to increase their production or adapt their schedules. This acceleration is forcing process modernization and increased digitalization to maintain manufacturing quality and safety.

Towards more sustainable production?

The increase in the number of devices produced naturally raises the question of the environmental footprint. Visit A320neo are designed to reduce fuel consumption and emissions per seat, thus contributing to the decarbonization objectives of air transport. However, producing more aircraft means working on decarbonizing the supply chain, logistics and the use of more sustainable resources, to avoid simply transferring environmental impact away from the engines themselves.

Key information

Production objective : 75 aircraft per month by 2027, according to Flywest, thanks to the commissioning of a second A320 line at the Mobile (Alabama) site.

Industrial impact: strengthening global capacity Airbus, closer proximity to the North American market and shorter delivery times for local airlines.

Economic benefits: direct and indirect job creation, increased demand from suppliers and modernization of industrial processes.

Environmental issues: the A320neo is helping to reduce fuel consumption per seat, but ramping up production requires a global strategy to limit the carbon footprint of production and logistics.

Consequences for carriers: greater availability of fuel-efficient aircraft, fleet renewal opportunities and potential for optimizing operating costs on domestic and regional routes.